With no shareholders to please, our profits are reinvested to benefit you.

Following the Reserve Bank of Australia’s decision to increase the cash rate, The Mutual Bank’s interest rates are currently under review.

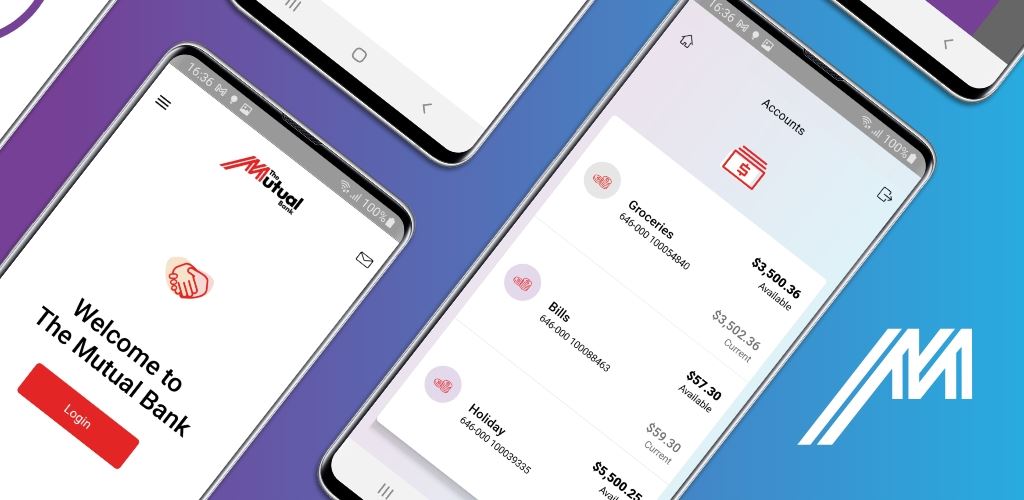

Whether you're saving for a special event, planning a holiday, building your wealth or investing with confidence, we have an account to suit your needs.

Enjoy competitive interest rates, secure banking and features designed to help your money grow. Whatever your goal, make it yours sooner with one of our savings or investment accounts.

Enjoy flexible banking options and access to your funds with The Mutual Bank's Cash Management account.

Earn a higher rate of interest on your savings with a Term Deposit. A Term Deposit is a secure way to grow your savings with terms available from one month to three years

Our Internet Saver account allows you to earn interest while being able to access your funds at your convenience. Tiered interest rates apply.

Looking for a savings account that encourages good savings habits? The Mutual Bank’s Bonus Saver account allows you to earn interest if you make one deposit and no withdrawals in a calendar month.

Mighty Mutual account, which offers bonus interest* for regular saving, is a great way to educate children on the importance of saving. Enjoy no coin handling fees, plus earn bonus interest for regular saving.

Christmas is a great time of the year - giving and receiving gifts, spending time with family and friends, maybe you are planning a holiday. Save a little each week and access your savings at the festive time of the year.

We’re proudly customer owned, which means we exist to benefit you. Not external shareholders. Whether you're opening your first account or planning for the future, we’re here with genuine service, great-value products and the kind of care only a mutual can offer.

View and compare our Transaction Accounts

Interest on Term Deposits is calculated by applying the daily percentage rate to the account balance and paid at intervals as specified in the tables above. The daily percentage rate is the applicable annual percentage rate divided by 365. We may allow you to break your Term Deposit before the Maturity Date, subject to you first providing us with a valid request in writing no less than 31 calendar days’ prior, unless financial hardship applies. At our discretion we may refuse to open or accept a Term Deposit at any time. If we allow you to access your term deposit funds before maturity, an interest rate reduction will apply. The amount of interest charged as an interest rate adjustment will depend on how early in the term you seek to access your funds. Percentage of term lapsed: 0% to less than 20% - Interest rate reduction 90% of your deposit rate 20% to less than 40% - Interest rate reduction 80% of your deposit rate, 40% to less than 60% - Interest rate reduction 60% of your deposit rate, 60% to less than 80% - Interest rate reduction 40% of your deposit rate 80% to less than 100% - Interest rate reduction 20% of your deposit rate

Interest is calculated by applying the daily percentage rate applicable to the daily balance to the entire balance and paid on the last day of every month. The daily percentage rate is the applicable annual percentage rate divided by 365. Interest will be calculated and paid if there has been at least one deposit and no withdrawals on the account during the calendar month. If this condition is not met, no interest will be paid for that month. Interest credits from this account do not constitute a deposit.

We have not considered your objectives, financial situation, or needs. You should consider these things, along with the Product Disclosure Statement and our product Target Market Determinations before making any decision to acquire a product.

Financial Claims Scheme information available at fcs.gov.au.