With no shareholders to please, our profits are reinvested to benefit you.

Following the Reserve Bank of Australia’s decision to increase the cash rate, The Mutual Bank’s interest rates are currently under review.

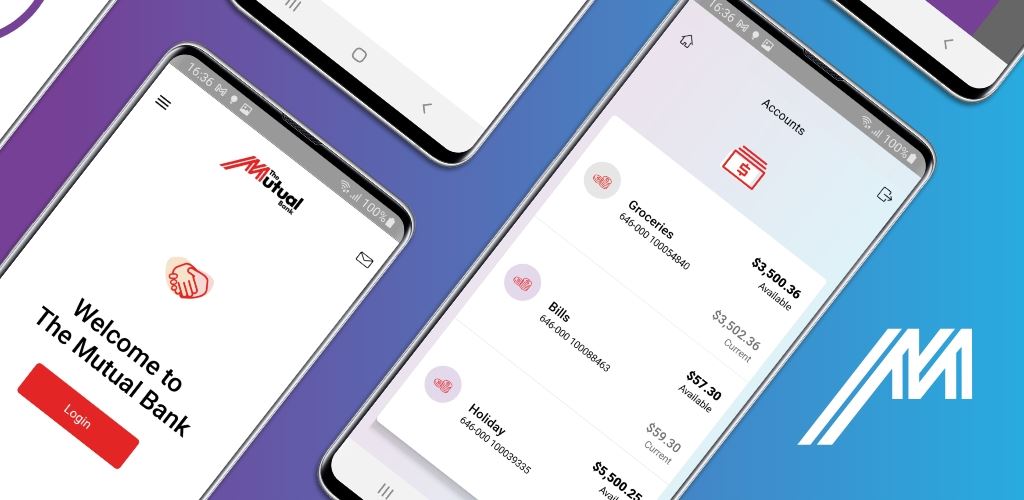

We offer a range of transaction accounts to help you manage your finances with ease. Whether you're looking for an account for everyday expenses, a first saver for your child or seeking options linked to your home loan, we have an account ready for you.

100% Offset account is a transaction account available with eligible variable rate home loans, which does not earn interest as the balance is offset against the loan balance, reducing the interest that you pay on your home loan.

Make the convenience of everyday banking yours when you unlock the benefits of our Everyday Account. Enjoy easy access to your money, taking your banking on the go with our app and quick, secure contactless payments.

The Retirement account is the smart option for over 55’s or if you receive a pension.

We’re proudly customer owned, which means we exist to benefit you. Not external shareholders. Whether you're opening your first account or planning for the future, we’re here with genuine service, great-value products and the kind of care only a mutual can offer.

View and compare our Savings and Investment Accounts

The daily percentage rate is the applicable annual percentage rate divided by 365.

Financial Claims Scheme information available at fcs.gov.au.